- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

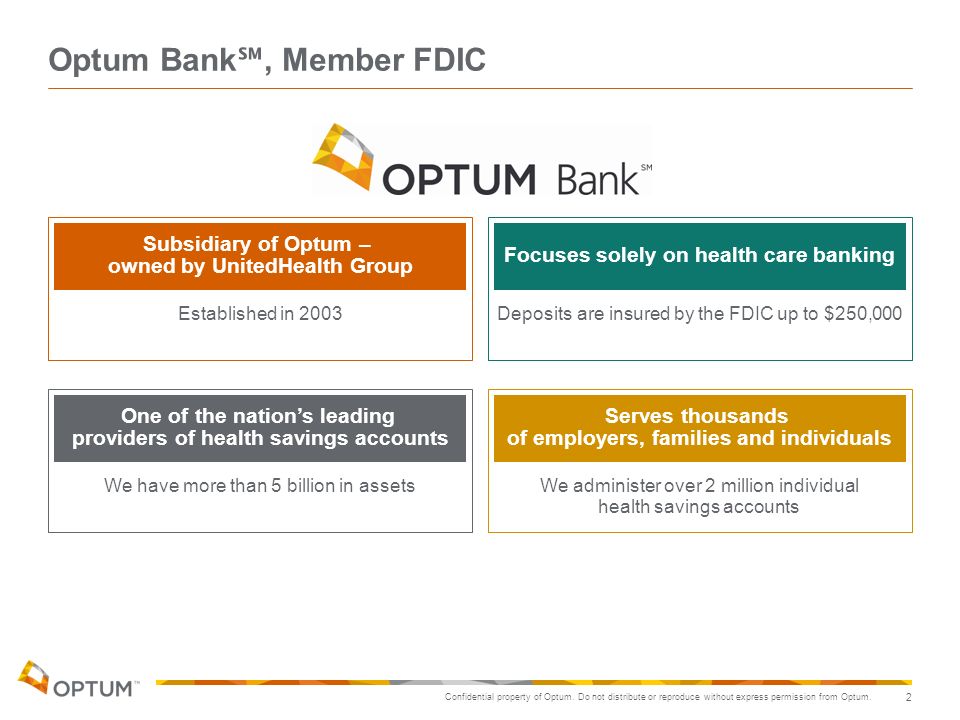

Optum Bank strongly recommends a teleconference between the existing HSA Trustee the Employer and Optums operations team in order to review the information provided in this guide and to confirm file format file naming convention and appropriate contacts. Heath savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties.

Optum Bank Data Tool Uses Artificial Intelligence Advanced Analytics To Help People Increase Health Savings Business Wire

Optum Bank Data Tool Uses Artificial Intelligence Advanced Analytics To Help People Increase Health Savings Business Wire

FSAsHRAs are administered by OptumHealth Financial Services Inc.

What is optum bank health savings account. Health savings accounts HSAs and Medicare Advantage Medical Savings Accounts MSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. Federal and state laws and regulations are subject to. State taxes may apply.

Health savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. As illustrated below the bulk funds transfer process from an. State taxes may apply.

The content on this website is not intended as legal or tax advice. State taxes may apply. Federal and state laws and regulations are subject to.

Plus you can get information about our helpful online tools and resources. This communication is not intended as legal or tax advice. Plus get access to tools resources and information tailored to their retirement needs.

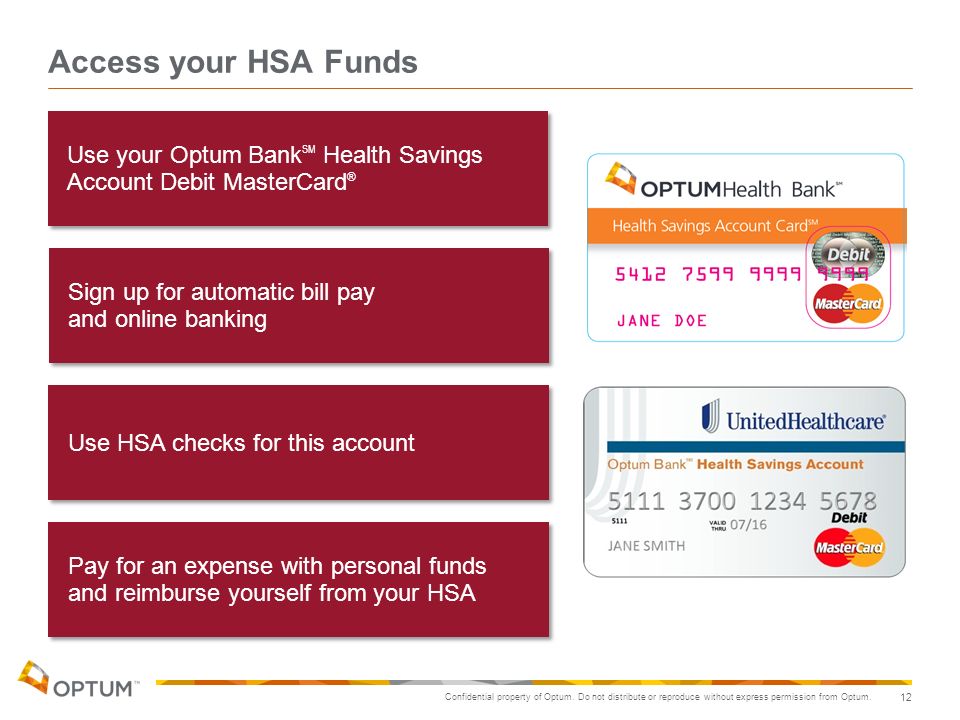

Money is contributed on a before-tax basis any gains accumulate tax-free and withdrawals are tax-free when used for qualified medical expenses. Heath savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. Fees may reduce earnings on account.

Federal and state laws and regulations are. State taxes may apply. Health savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties.

Flexible spending accounts FSAs and health reimbursement accounts HRAs are. Explore all the ways were making it easy for you to get the most out of your HSA. Health savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties.

You can carry over unused funds from year to year and the account is yours to keep even if you change jobs change health plans. Federal and state laws and regulations are. Fees may reduce earnings on account.

Members with a qualifying high-deductible health plan can take advantage of tax benefits as they save for qualified medical expenses. Fees may reduce earnings on account. 2000 charge to transfer your HSA to another bank or custodian outbound transfer of your entire HSA or a portion.

Looking for more details. In addition to the Optum Bank ATM fee the bankATM you use to withdraw funds may charge you a fee. State taxes may apply.

Federal and state laws and regulations are. Flexible spending accounts FSAs and. State taxes may apply.

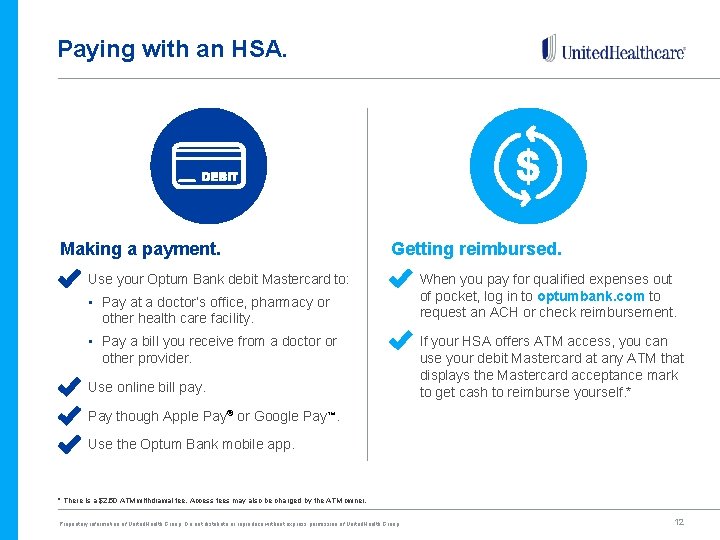

Welcome to your Optum Bank health savings account HSA. Federal and state laws and regulations are subject to change. Fees may reduce earnings on account.

Flexible spending accounts FSAs and. State taxes may apply. Fees may reduce earnings on account.

Here youll find out how to use your account. This communication is not intended as legal or tax advice. That means the FDIC will cover the funds in your deposit account up to 250000 in the unlikely event Optum Bank goes out of business.

Health savings account HSA user guide. Fees may reduce earnings on account. Health savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties.

State taxes may apply. Health savings accounts HSAs and Medicare Advantage Medical Savings Accounts MSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. This communication is not intended as legal or tax advice.

Discounted Fees and Tax Advantages. This communication is not intended as legal or tax advice. The content on this website is not intended as legal or tax advice.

250 per ATM transaction that Optum Bank charges. Health savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. Optum Bank is a member of the Federal Deposit Insurance Corporation FDIC in order to keep the funds in your HSA deposit account safe.

State taxes may apply. Health savings accounts HSAs are individual accounts offered or administered by Optum Bank Member FDIC and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. Fees may reduce earnings on account.

ATM Withdrawal with Health Savings Account Card. Fees may reduce earnings on account. Health savings accounts HSAs are individual accounts offered by Optum Bank Member FDIC and are subject to eligibility and restrictions including but not limited to restrictions on distributions for qualified medical expenses set forth in section 213d of the Internal Revenue CodeState taxes may apply.

FDIC this Health Savings Account Transfer Guide was established. Optum Bank is the best HSA account for investment management because of the array of tools and features it offers through Betterment an online robo-advisor and cash management company including auto deposit investment sweeping automatic portfolio rebalancing dividend reinvestment and receipt storage. And are subject.

Fees may reduce earnings on account. An HSA is a savings account designed to work with health plans like Libertys Consumer Directed Health Plan CDHP options.

Http Cdn Optumhealth Com Oh Ohb Welcome Email Forms Optumhealth 20bank 20contribution 20guide Pdf

Http Maconit Com Content Documents Optum 20hsa 20how 20to 20open 20flier 20100 11524 Pdf

Health Savings Account Hsa Benefits Services Division

Health Savings Account Hsa Benefits Services Division

How Hsas Triple Tax Benefits Save Consumers Money

How Hsas Triple Tax Benefits Save Consumers Money

Http Cdn Optumhealth Com Oh Ohb Welcome Email Forms Optumhealth 20bank 20contribution 20guide Pdf

Optum Bank Overview Health Savings Account Hsa Mt1181168

Optum Bank Overview Health Savings Account Hsa Mt1181168

What Is The New Lasso Medical Savings Account Msa

What Is The New Lasso Medical Savings Account Msa

Common Hsa Eligible Ineligible Expenses Optum Bank

Common Hsa Eligible Ineligible Expenses Optum Bank

Overview Of Your Health Savings Account Hsa Confidential Property Of Optum Do Not Distribute Or Reproduce Without Express Permission From Optum Ppt Download

Overview Of Your Health Savings Account Hsa Confidential Property Of Optum Do Not Distribute Or Reproduce Without Express Permission From Optum Ppt Download

Https Www Huntingtonbeachca Gov Government Departments Human Resources Employee Benefits 2018optumbankhsaplan Pdf

Overview Of Your Health Savings Account Hsa Confidential Property Of Optum Do Not Distribute Or Reproduce Without Express Permission From Optum Ppt Download

Overview Of Your Health Savings Account Hsa Confidential Property Of Optum Do Not Distribute Or Reproduce Without Express Permission From Optum Ppt Download

Optum Bank Overview Health Savings Account Hsa Mt1181168

Optum Bank Overview Health Savings Account Hsa Mt1181168

Save For Retirement With An Hsa

Save For Retirement With An Hsa

Comments

Post a Comment