- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Consolidated Medical Billing Boosts Collections for a TX Group Abilene Diagnostic Clinics CFO shares how a consolidated medical billing experience lowered patient AR from 14 to 2 percent and allowed independent physicians to stay independent. Debt management is another type of consolidation program that can help you pay off collection accounts.

5 Ways To Handle A Surprise Medical Bill Money Under 30

5 Ways To Handle A Surprise Medical Bill Money Under 30

How to Rebuild Your Credit After Medical Collections.

Consolidate medical bills in collections. This is done to simplify the management of unpaid bills. Some offer lower interest rates than others. All you need to invest proper time in the research and opt for a genuine debt consolidation plan that can be reliable for you.

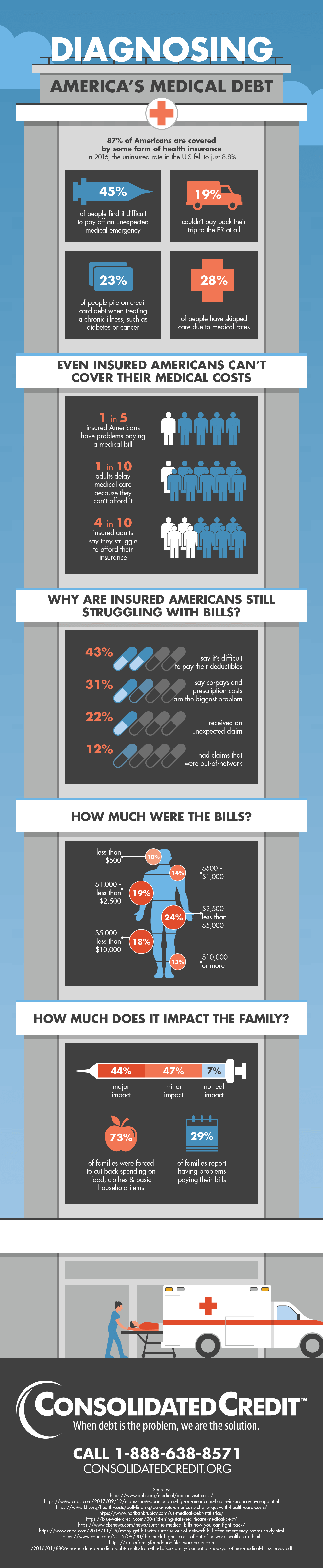

Medical Bill Consolidation Options A consolidation loan designed to help with medical bills will mean youll pay interest on a previously interest-free debt but it will also keep that debt from becoming a black mark on your credit. With millions of American struggling with health care expenses consolidating medical debt is becoming more common and is a great option for people to consider. Turn the tables on medical bills debt collectors and reporters possibly netting you thousands of dollars in the process.

If you have multiple unpaid bills you could consolidate them together using a credit card that offers a 0 APR on purchases. Several lenders have loans designed specifically for consolidation. Dont despair medical bills are consumer debts and medical debt collection gives you rights under medial bill collection laws like the Fair Debt Collection Practices Act and Fair Credit Reporting Act.

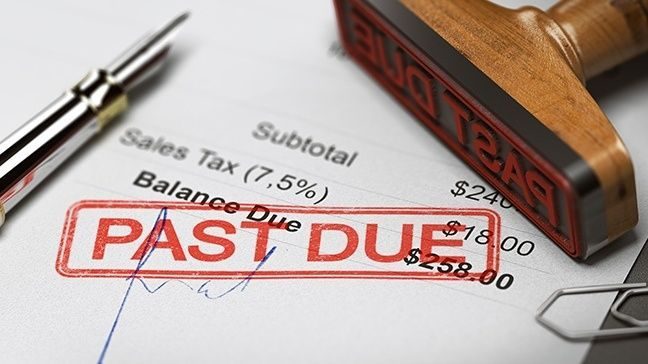

While paying your medical bills directly to your health care provider can offer low or no interest charges multiple medical bills. Here are some tips for consolidating medical debts. These accounts get listed in the public records section of your report and count as a negative item.

The goal of any medical debt consolidation program should be to reduce your monthly payments to a manageable level. Medical debt consolidation is particular ways that will help you in coping with a healthcare expense. Medical bill consolidation implies taking out a loan to pay back a hospital clinic or doctor.

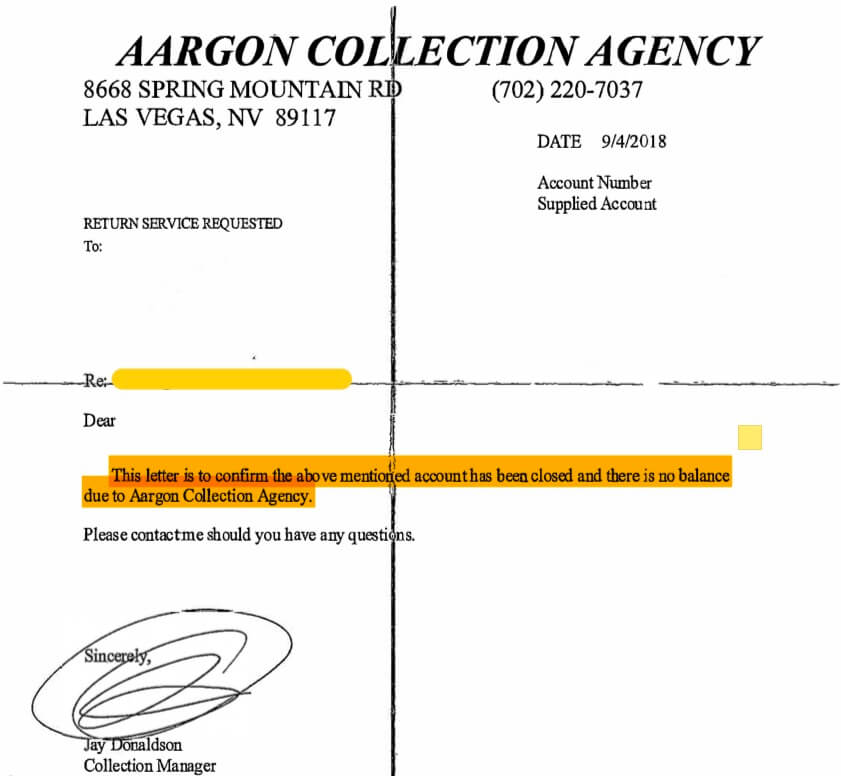

Paying off your medical collection account is a good first step to rebuilding your credit. All you need to hand over medical bills to a company and get rid of unexpected medical bills with ease. Pay off any past-due debts.

A trained counselor will help you establish a budget and you will begin by sending a combined payment to one company rather than multiple places. The phone call or letter notifying you that your bill has been sent to collections only adds to the anxiety and pressure. As a result bills that used to come from different sources will be associated with only one creditor.

The management company may negotiate a payment plan with the collection agency. How you approach medical debt consolidation depends on the status of your medical bills. Make sure you send in your payments on time every month to avoid credit score damage.

Tap into your home equity If you have equity in your home you could pay off. If you have a lot of medical bills one good option is to start paying them off through medical debt consolidation. Rebuilding your credit when you have a collection account on your report can seem daunting but there are some steps you can take to start improving your credit right away.

Is it in my best interest to consolidate medical debt. Once a medical bill is in collections it becomes medical debt. Even if a medical bill passes to collections it may accrue penalties but there is still no applied interest rate.

While some forms of consolidation deal only with medical and hospital bills or debt others may combine several unrelated accounts. Look for a card that offers an introductory period thats long enough to give you enough time to pay the balance off. Consolidate your medical debt and bills.

But if you the due date is no longer extended the bill will go to collections after 90 to 180 days of non-payment. A consolidation loan allows you to pay off the bills or debt in collections in a lump sum to avoid the hassle of setting up repayment plans with individual medical providers. Its important to note that medical debt does not have any interest rate applied to it.

This means if you use a debt consolidation loan to get out of medical debt you convert debt with no interest charges to debt that has interest. The Consumer Finance Protection Bureau reported in March of 2020 that 52 of all debts in collection are medical bills. A collections account has a negative effect on your credit report.

What To Do When You Get Medical Bills You Can T Afford

What To Do When You Get Medical Bills You Can T Afford

Medical Debt Consolidation For Unpaid Bills Consolidated Credit

Medical Debt Consolidation For Unpaid Bills Consolidated Credit

How To Deal With Medical Debt Collections Debt Com

How To Deal With Medical Debt Collections Debt Com

Medical Debt Consolidation Pay Off Your Bills Debt Com

Medical Debt Consolidation Pay Off Your Bills Debt Com

Medical Bill Debt Forgiveness How To Reduce Your Hospital Bill Magnifymoney

Medical Bill Debt Forgiveness How To Reduce Your Hospital Bill Magnifymoney

Medical Bill Nightmares Medical Expenses Debt Credit Com

Medical Bill Nightmares Medical Expenses Debt Credit Com

How To Deal With Medical Debt Collections Debt Com

How To Deal With Medical Debt Collections Debt Com

Medical Debt Consolidation How To Get Help

Medical Debt Consolidation How To Get Help

3 Best Ways To Get Help With Medical Bills In 2020 A Free Quick Guide

3 Best Ways To Get Help With Medical Bills In 2020 A Free Quick Guide

What Are The Best Ways To Clear Medical Debt

What Are The Best Ways To Clear Medical Debt

What To Do When You Get Medical Bills You Can T Afford

What To Do When You Get Medical Bills You Can T Afford

5 Ways To Handle A Surprise Medical Bill Money Under 30

5 Ways To Handle A Surprise Medical Bill Money Under 30

Medical Debt Consolidation Should You Do It

Medical Debt Consolidation Should You Do It

Comments

Post a Comment